It is important to understand the cost you will incur and the benefits you gain from a given health insurance plan. There is a wide collection of choices available in the market and making the right choice is hard.

Health insurance is a big industry in which healthcare providers and insurance brokers are a part of. The key to getting the best plan for your family lies in understanding the health insurance business. How does health insurance work?

Firstly, it is important to understand the terms used in health insurance.

Premium: This is the amount of money you must pay each month for an insurance policy. Paying a higher premium guarantees you lower coinsurance and deductibles. When you choose this plan, the insurer will foot most of your medical costs. A low premium has high deductibles, which means you will be responsible for most of your medical expenses.

Coinsurance: This is a form of cost sharing whereby the insured pays part of the covered costs before the insurer steps in. Coinsurance kicks in after you have met your deductible. The impact of coinsurance in a high deductible plan is low. But it is very important in a low deductible plan.

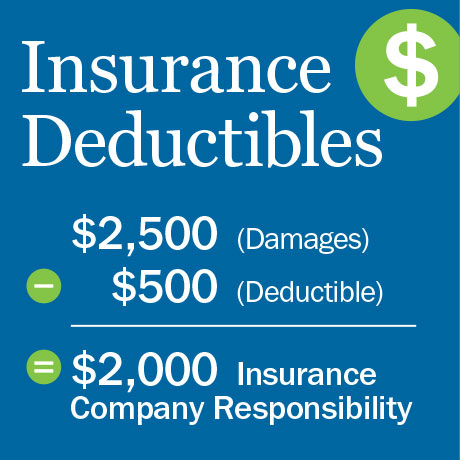

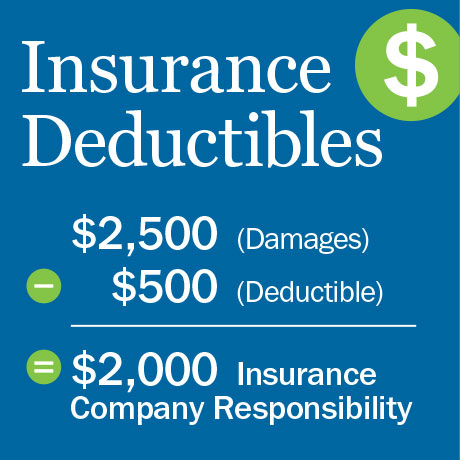

Deductible: This is the amount of money you must pay every year before your insurer steps in. Deductible contributes to the maximum out-of-pocket amount.

Out-of-pocket maximum: This is the greatest amount you will pay for insurance-covered costs per year before the insurance company pays 100% of the remaining costs.

Copay: This is a specified sum of money you pay for covered services when you receive the service. It covers costs of buying drugs and services you may need from the first day of the insurance policy. You won’t be required to pay a deductible.

Dollar limit: There is the maximum amount that your insurer can pay for covered costs. They do not apply for essential health benefits. Most marketplace health plans cover essential health benefits that are needed to stay healthy. These include vaccine shots, check-ups, cancer treatments. You may be required to pay for copay and coinsurance for some of them.

There are networks in health insurance such as “in-network”, which is highly recommended, where your plan covers complete cost of covered services as agreed upon in the cost sharing contract. Also some things are “out-of-network” meaning that your plan either doesn’t cover them or the cost covered is low. You should consult with your insurance provider to find out how does health insurance work when you go out-of-network.

The Modified Adjusted Gross Income for your household is often calculated to determine if you are eligible for cost assistance and whether you can afford a particular health plan. Also, you should understand how does health insurance work in order to choose a plan that will not burden you. Young individuals should consider plans that have low premiums and affordable deductible and out-of-pocket maximum. Older people need a premium plan that includes copay and coinsurance.