When buying auto, home or health insurance, it is highly advisable that you understand the amount of deductible you are required to pay in order to make an informed decision.

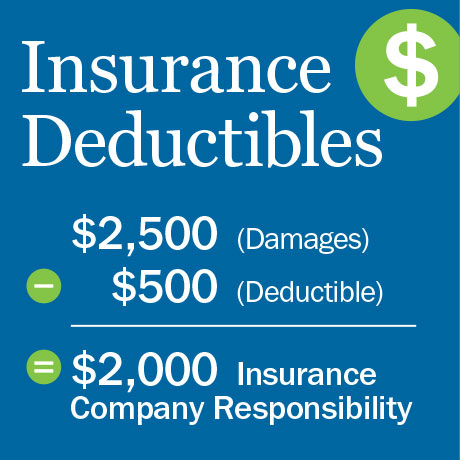

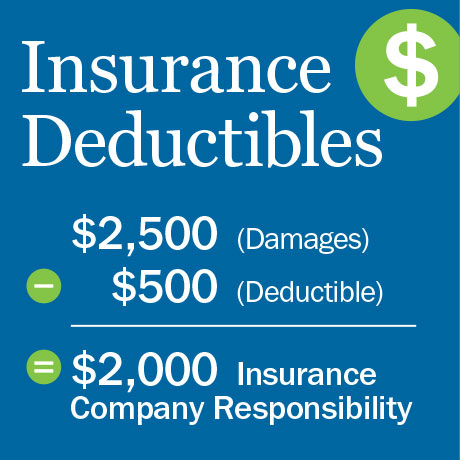

A deductible insurance is the amount of money you have to pay from your own pocket before your insurance company steps in and pays the rest. With home and autoowners insurance, you have to settle a certain amount as agreed upon in the contract to cover damage to your car or house respectively. The same is also true for initial health costs in the case of health insurance.

Let us use car insurance as an example. If you are involved in a car accident that results in damages worth $2000 and your deductible is $500, you will be required to pay $500 only for repairs. The insurance company would pay the remaining $1500.

The policyholder enters into an agreement with the insurance company to share the cost of insured loss that may be incurred. A deductible insurance is basically the amount deducted from the total insurance claim. It can range from a few hundreds to thousands of dollars. A maximum amount, that shouldn’t be exceeded, is always agreed upon when negotiating the insurance policy.

Deductible insurance is an important part of the insurance contract that serves an important role when settling claims. Its main purpose is to prevent policyholders from making many claims that involve low costs that they could otherwise afford to pay for themselves. Insurance companies are now left to compensate claims that involve large costs for only a few times a year.

In the insurance business, deductibles go hand in hand with premiums. The deductible determines the amount monthly insurance premium you pay for your policy. That is, when the amount of deductible is high, the premium will be much lower and vice versa. Paying a large deductible is a good way to save money for most people.

When choosing the appropriate insurance plan, it is vital to choose the amount of deductible that you can afford. Note that, insurance companies will only pay for damages to your house or car after you have paid your deductible in full. Also, deductibles only cover property you own and cannot be applied to liability claims (damages suffered by third parties). E.g. when you hit a pedestrian with a car or when a person gets injured in your home.

Things are a little different for health insurance. Most health plans provide the insured with benefits such as preventive care, doctor visits or prescription pills without requiring you to pay the deductible.

For auto and homeowners insurance, deductibles are applied each time you file a claim in case of damage. In health insurance, it could be hard to delimit the number of hospital visits so the deductibles are applicable annually.

Deductible insurance could either be a fixed amount or a percentage of the total amount of insurance in the policy. Usually, it is indicated in the clause of the insurance policy.